First published on Thursday, December 4, 2025

Last updated on Thursday, December 4, 2025

It is widely known that the national minimum wage rates increase each year, reflecting the rising cost of living.

While this comes as positive news for the working population, for small business owners, many are still dealing with high costs and budgets that have been squeezed tightly.

For those already strapped for cash, how will these wage increases impact businesses? And what can be done to ensure compliance with new NMW and NLW rates?

What do business owners need to be aware of?

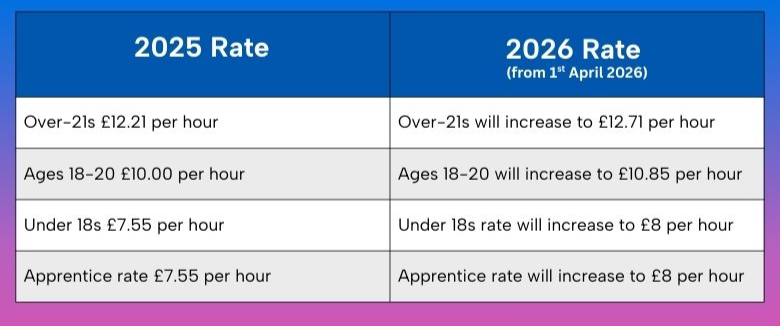

The new rates come into effect from 1st April 2026 and they are as follows:

How to update your payroll in line with new rates

As an employer you are responsible for making sure your employees are paid accurately and on time. With the new rates coming into effect from April 2026, it’s important to update your payroll processes before it’s too late.

This requires checking the correct rates for individual employees. Remember, depending on the age of your employee and whether they are an apprentice, rates differ.

Identify these rates and audit your payroll processes, updating your employees’ pay. Be sure to check deductions too, as these can quickly take an employee’s pay below the NMW or NLW.

The National Minimum Wage Act 1998 is governed by HMRC. Your payroll must comply with this law, ensuring that you do not put your business at risk of hefty fines and even employment tribunals.

If an employee believes that they have been underpaid or are not paid correctly according to the new rates from April 2026 onwards, they can report you to HMRC. To read more about the wage standards in the UK and the role of HMRC, see our articles below:

How will the new UK wage standards impact small businesses?

Businesses in the retail and hospitality sectors are the most likely to bear the brunt of these increases, since a large majority of their employees are on minimum wage.

These industries have already dealt with more than their fair share of cost increases over the past 5 years with both the energy crisis and increases to national insurance contributions tightening the purse strings. There’s no doubt these wage increases will be felt by business owners.

Employers in these sectors will need to review and adjust their employee pay and possibly consider making cutbacks or saving on recruitment.

How can you prepare?

Finding solutions to save money is something all businesses can benefit from.

BrightHR can support you in helping reduce admin costs and save you time. Meanwhile our CIPP qualified payroll team is on hand to support you in preparing your payroll ahead of the new NMW and NLW increases for 2026.

To find out more book a free demo to discover HR and payroll software.